A group of kindergarten students work on a pretest in their first-ever MyFuture class at Rappahannock County Elementary School. (Photo/Ireland Hayes)

Money smarts start in kindergarten

Most adults wish they had learned more about money management before life started sending them bills.

In Rappahannock County Public Schools, students are getting that head start thanks to FamilyFutures, a local nonprofit that provides real-world financial knowledge and savings accounts to help kickstart their futures.

Founded in 2019, the organization’s mission is to help public school students “learn to earn, save, and thrive.” The group opens savings accounts for every student entering Rappahannock County Public Schools (RCPS), seeding each with a $100 deposit. Students earn up to $100 each year by completing lessons and activities on key financial concepts.

When the students graduate, they gain full access to the accounts.

“[A student’s] feeling of competence in this important arena of life is huge,” said Alexia Morrison, board chair emeritus and current board member of FamilyFutures. “Our long-term goal is to graduate Rappahannock County High School students who are confident, competent, money-savvy adults.”

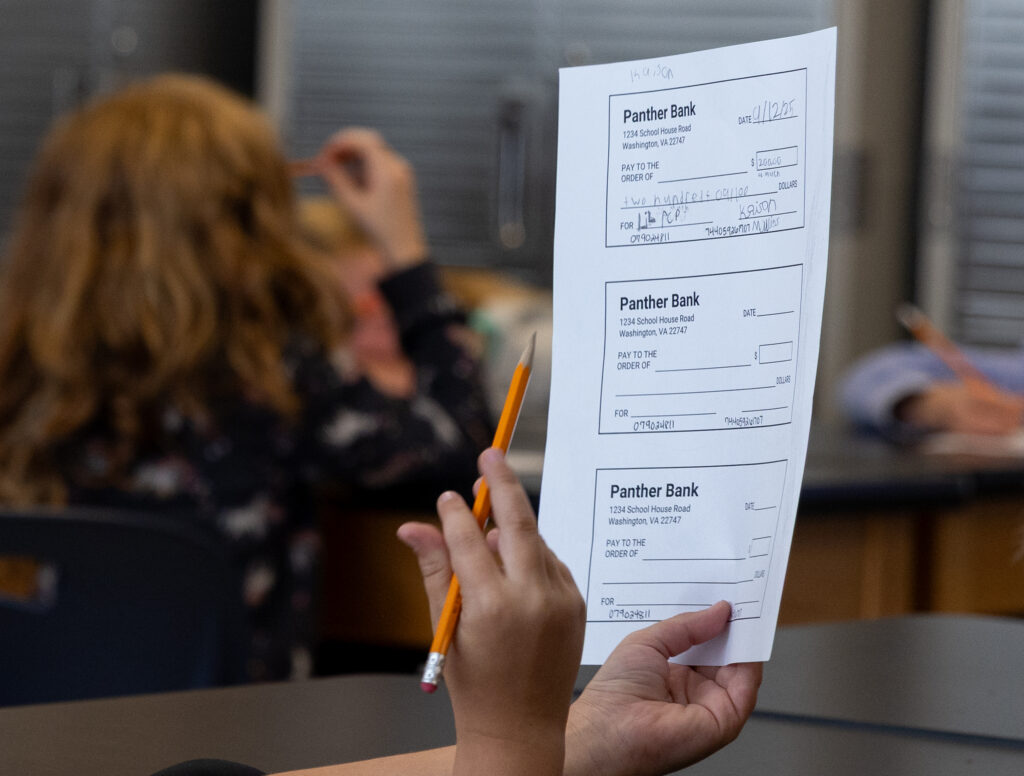

A fourth-grade student holds up his worksheet of “Panther checks” as he and his classmates are taught how to fill out a check. (Photo/Ireland Hayes)

Starting in kindergarten, through the organization’s MyFuture in-school program, students attend a once-a-month class with financial literacy teacher Erin Sherry. Courses range from kindergarten students learning the difference between a want and a need to middle school students calculating salaries and exploring taxes and loans, according to Sherry.

Those lessons are reinforced by the tangible experience of watching their savings grow. Quarterly, students receive a statement from Oak View National Bank showing their new balance and earned interest — 5% up to the first $1,000, thanks to the bank’s partnership with FamilyFutures.

Morrison said this FamilyFuture’s model is unique. “We haven’t really come across a program like ours,” she added.

The collaboration with RCPS, where the nonprofit operates inside the public schools, is also unique, Sherry said, and has been essential to the program’s success.

Jacqui Lowe Barton, elementary school principal, said the seven-year partnership has not only taught students financial literacy concepts, but also strengthened their understanding of core concepts like math, reading and life readiness.

Erin Sherry helps a table of kindergarten students with a pre-test, an assessment used to see what knowledge the class is starting out with. The kindergarten test included concepts like what is the difference between a want and need, and what it means to save money. (Photo/Ireland Hayes)

“It’s an important piece that … is not in our [standards of learning], but that doesn’t mean it’s not important,” Lowe-Barton said. “It’s teaching really complex financial literacy components … but they’re also developing foundational skills that pair in with this financial literacy piece.”

Students are assessed at the beginning and end of each school year to measure both their progress and the program’s effectiveness.

“The results of that assessment tell us whether we’ve pitched our targets at the right level. If they all knew it already, then we have to up the game. If people are totally in the dark, then maybe we should tweak it,” Morrison said.

Sherry believes that the program’s long-term impact will be measured years from now, when today’s students are managing their own finances.

“A lot of times, the kids will say to me, ‘Mrs. Sherry, why are you teaching us this? We’re just kids,’” Sherry said. “I always tell them, ‘It’s because I want you to remember a little bit of this. So whenever you’re an adult, you go, ‘Oh, yeah. I do remember learning about this,’ rather than being shocked, going, ‘Why did no one ever tell me?’”

A fourth-grade student practices filling out paper checks as financial literacy teacher Erin Sherry guides the class through the process. (Photo/Ireland Hayes)